Today people are talking about Mitt Romney's statement that "corporations are people too". Jonathan Chait points out that a favorable interpretation would be that he is actually correct. While there is a legal implication for corporate personhood,

That is not the point Romney was making. Romney was saying that taxes on corporations are in fact borne by people. Romney probably wouldn't admit that these are people who partially or completely own corporations, and thus far richer in the aggregate than the general public. But the fact is that they are people. Raising taxes on corporations is simply raising taxes on a certain category of people.It was further pointed out to me that a significant portion of corporate shareholders are indeed middle class pensioners, 401k holders, etc., and that taxes on corporations come at the expense of these people, not the "fat cats" we tend to think of when we think of the wealthy CEOs, managers and large individual stockholders.

The original heckled response was that corporations ought to be taxed to pay our bills. And Romney put his foot in his mouth before he was even able to make the inevitable supply-side case that not only should we not tax corporations, but that we shouldn't be taxing anyone. By which of course, he means the rich - the "job creators", etc. This is now the standard Republican answer to every problem.

Because taxes are no longer an important civic responsibility, to be shared especially by those who most can afford to. Teachers, police, medicare and social security are expenses that a decent society is willing to pay. It does so through taxes. The regressive, "flat tax" idea assumes these expenses will be paid for by because we'll get enough revenue from the increased growth unleashed by having flattened our tax base.

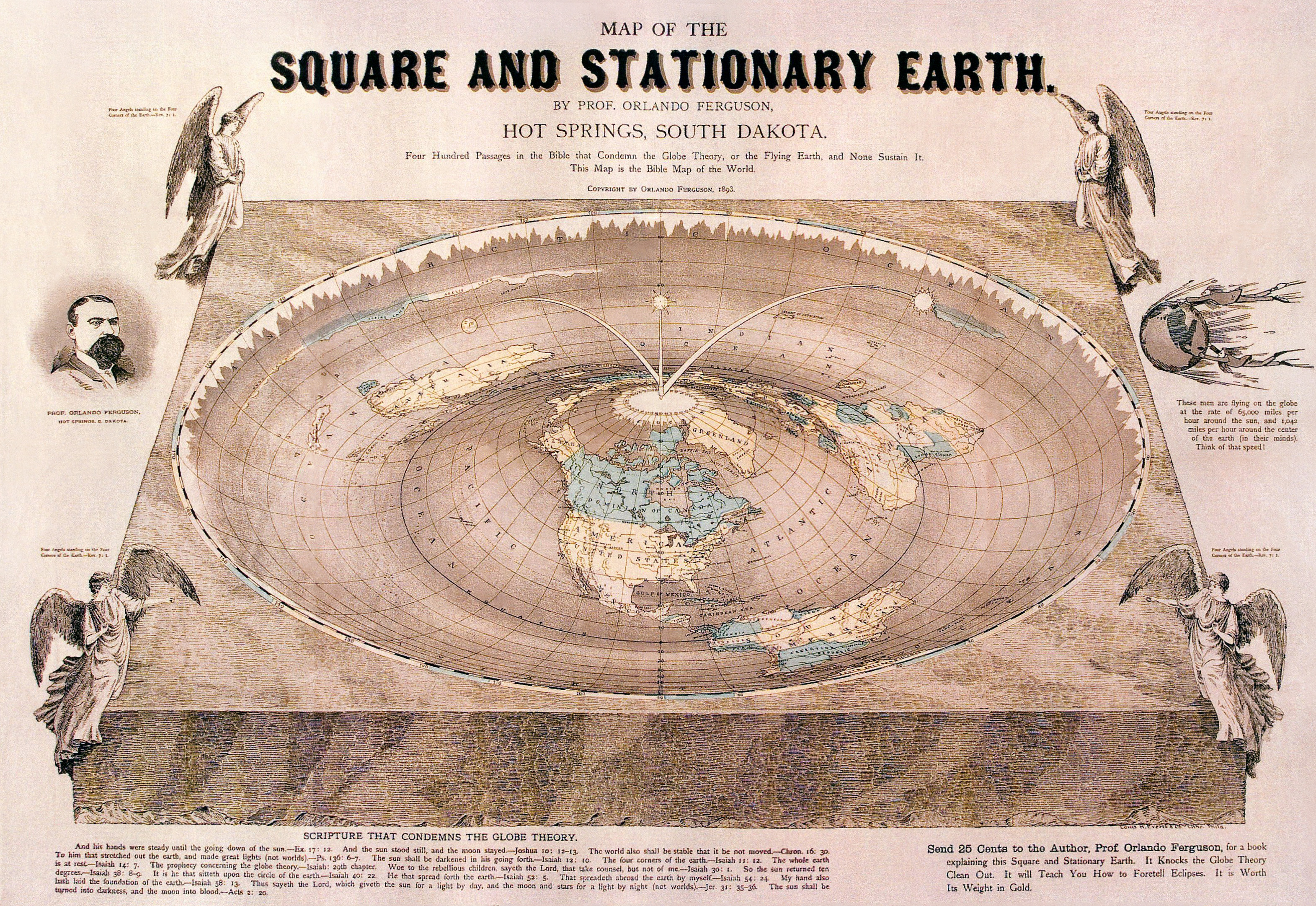

We did a slight form of this with the Bush tax cuts 10 years ago, and the growth never appeared. There never has been evidence of this so called supply-side miracle. Yet people still call for cutting taxes on the rich. Like members of the Flat Earth Society, they continue to deny evidence in favor of ideological fantasy. Either that, or they cynically promise that growth will pay our bills, while secretly knowing that a future collapse is inevitable.

No comments:

Post a Comment